Net, Gross, and Tax Total Calculations for Items

Learn how Net, Gross, and Tax totals are calculated and recalculated for items in Precoro documents.

In the following documents: Purchase Requisition, Purchase Order, Invoice, Credit Note, and Expense.

If you edit the Gross Total of the item, the Net, Tax amount (according to the set tax rate), and Price will be automatically recalculated according to the changes.

| Initial numbers: | After editing the Gross Total: |

| Gross Total = 1200 |

Gross Total = 1300 |

| Tax = 20% | Tax = 20% |

| Tax amount = 200 | Tax amount = 260 |

| Net Total = 1000 | Net Total = 1040 |

If you edit the Net Total of the item, the Gross, Tax amount (according to the set tax rate), and Price will be automatically recalculated according to the changes.

If you edit the Tax amount of the item, the Gross Total will be automatically recalculated according to the changes. In this case, the recalculations will not change the Tax rate, Price, and quantity. You can trigger the recalculation if you change the item quantity or the Price or add/delete the Tax itself.

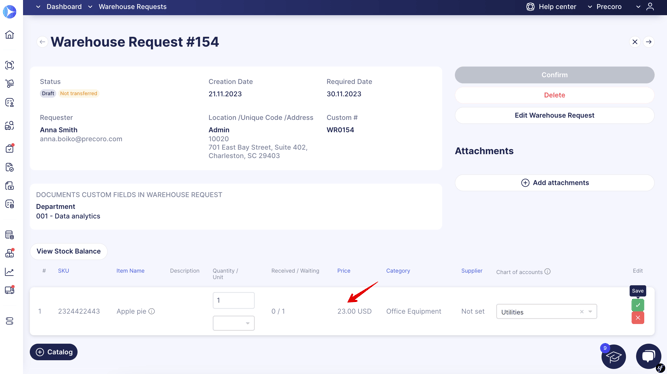

For the Warehouse Request document, you can add the items from the Catalog, and the Price for them is set in the Catalog:

In the Requests for Proposals documents, the item Price is entered by the Supplier and sent for your consideration.

In the Receipt document, the item’s Price can be found in the related Purchase Order document: