How to Set the Deducted Sum for a Budget in Net or Gross Total or Using Custom Formula

Learn how to set the deducted sum for a budget in Precoro.

TABLE OF CONTENTS

- How to Configure the Deducted Sum when Creating a Budget

- How to Edit the Deducted Sum

- How to Set Your Custom Formula for the Deducted Sum

- How to Set the Totals You See in the Document Lists in Gross or Net Total

Gross Total is the default setting in the total deducted sum.

You can change the deducted sum to Net Total or your custom formula for each budget separately and change the default deducted sum in Basic Settings.

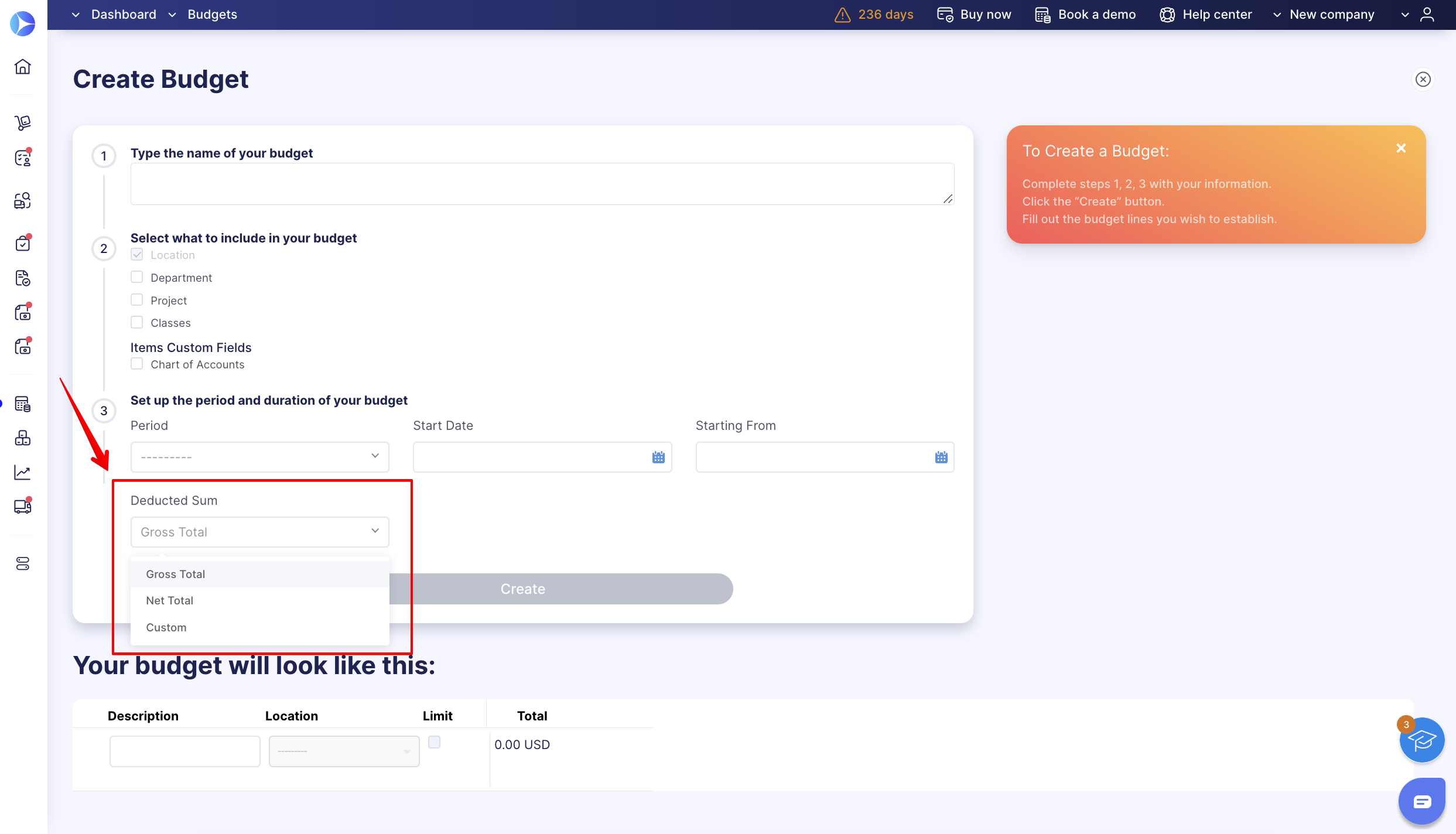

How to Configure the Deducted Sum when Creating a Budget

Choose the appropriate Deducted Sum option when creating a Budget:

- Gross Total — the total amount including taxes and any additional charges.

- Net Total — the total before taxes or other deductions.

- Custom — this option allows you to set your own calculation of the deducted sum in documents.

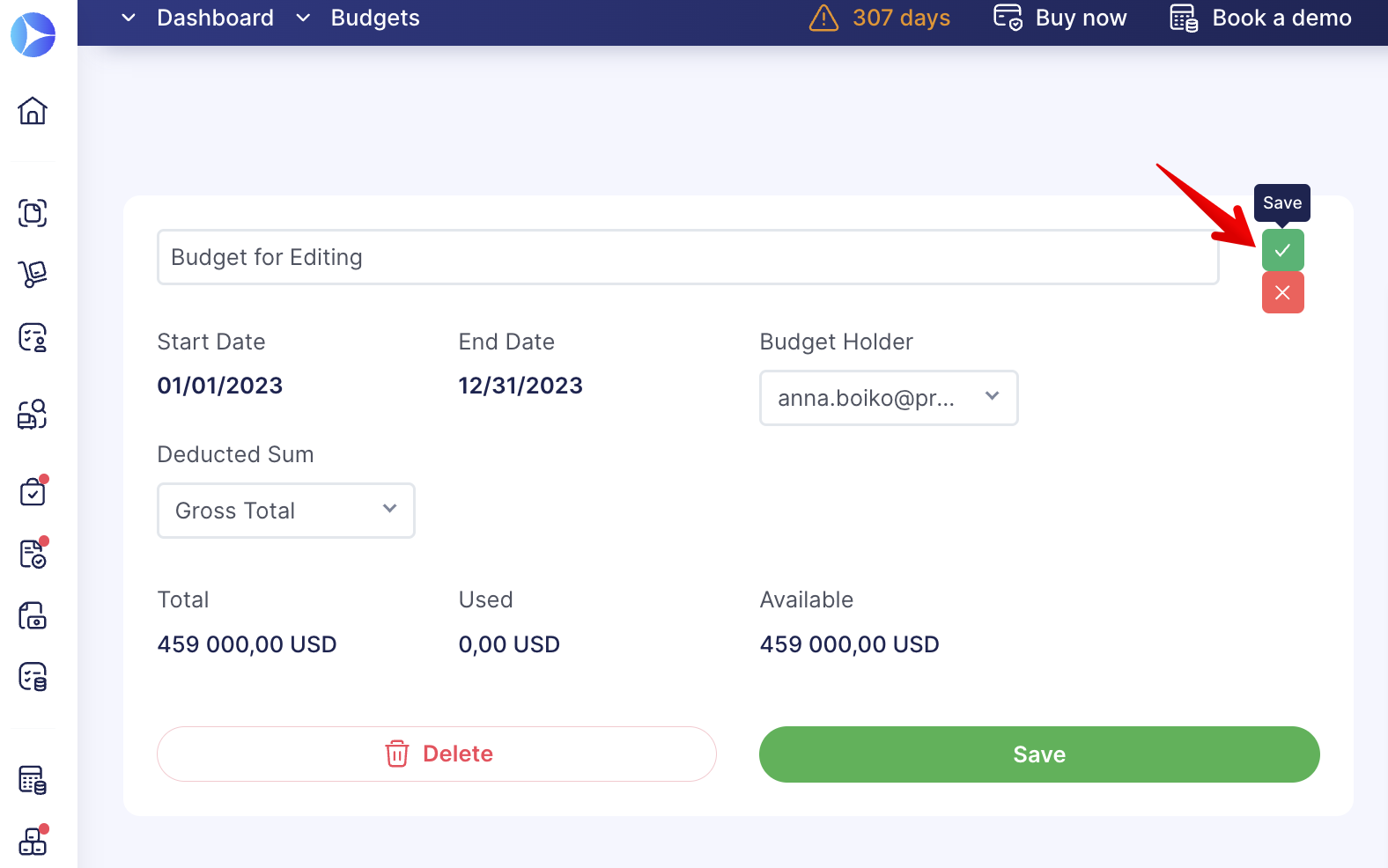

How to Edit the Deducted Sum

On the Budgets list page, press the Edit Budget button and choose the Deducted Sum option you need, then press the green checkmark to save the changes made.

💡 Please note: The Deducted Sum field will be unavailable for editing if there are active documents created with this budget (those that have statuses other than Draft).

💡 Please note: Your budget usage will be recalculated by changing the amount deducted directly from the budget.

The amount Used and the Reserved Sum will be greater if you change from Net Total to Gross Total and less if you switch from Gross Total to Net Total.

How to Set Up Your Custom Formula for the Deducted Sum

You can set up a default custom formula for all your new budgets in the Configuration → Basic Settings → Documents Setup → Budgets → Custom Deducted Sum.

When creating a new budget, the set custom formula will be automatically displayed for the users as the Deducted Sum.

💡 Please note: Budget creators will still be able to manually change the needed type of Deducted Sum for each budget.

You can set up a tax percentage you want to be calculated in the deducted sum in the custom formula when creating or editing a specific budget:

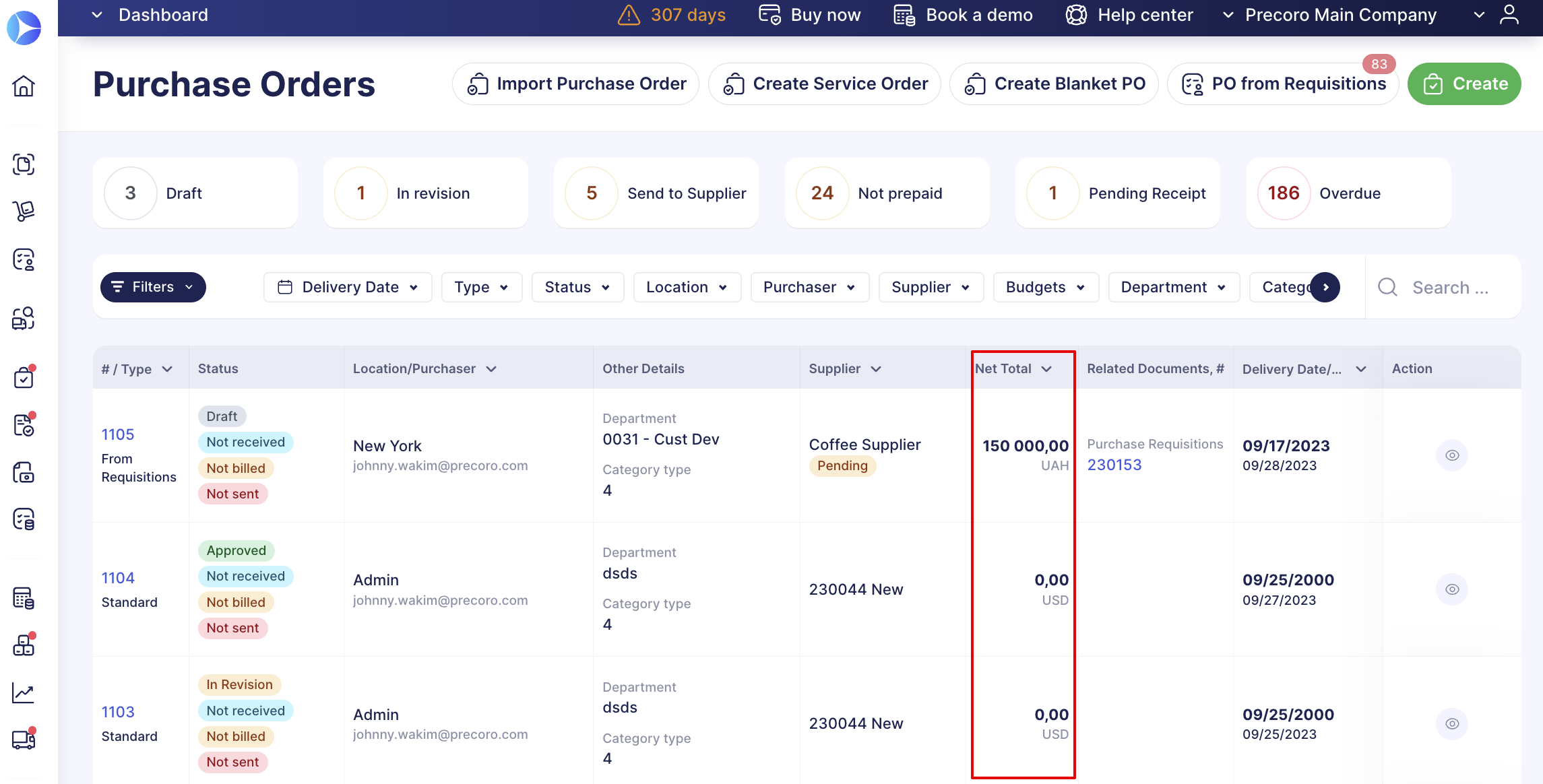

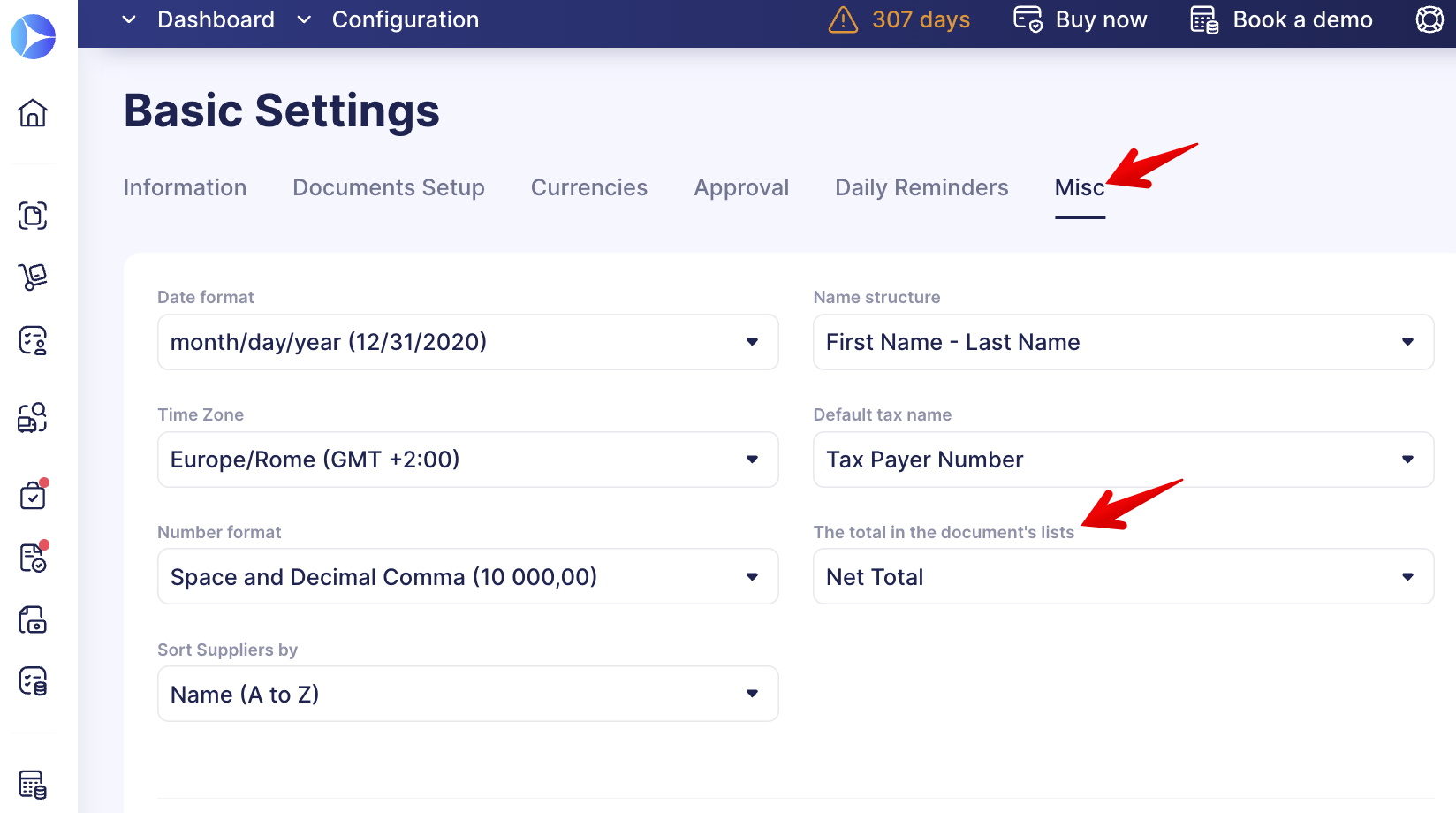

How to Set the Deducted Sum Display in the Document Lists

You can set which type of calculation you want to see in the document list, whether it is Net or Gross Total:

To do that, open and select the needed setting in the Configuration → Basic Settings → Misc → Total Shown in Document Lists.

When you switch to Net Total or Gross Total, you will see the following changes:

- Within the lists of documents.

- Approval thresholds.

- Minimum order total.